Socialism vs the Single Tax

"The fight of labour is not against capital, it is against monopoly"

Socialism vs the Single Tax

“Ten jobs for every nine men, then no man will coerce labor because labor cannot then be coerced.” - Louis Freeland Post

In obscure years before the Great War, two paradigms collided. Socialism versus the Single Tax set the trajectory of the twentieth century - enterprise, invention and productivity struck by depression, revolution and war. The collision destroyed knowledge, fatally skewing our understanding of the boom-bust, of unemployment and economic inequality. A conceptual black hole now occupies the point of contact. Yet from it one paradigm birthed, painting itself across history, while the other ... was obliterated.

Fragments of the collision can be found: for instance, in Chicago a few days before Christmas 1903, a fractious, rowdy audience of two thousand heard six speakers debate the resolution “That it is to the interest of the working class to take up the propaganda of Socialism rather than that of the Single Tax". The transcript was published as a book. The extracts below are something quite rare - a stenographic record, including audience participation, featuring experts in the medium of the day - public debate. Through it, might we somehow re-enter the gestalt of this deleted debate, grasp its deleted concepts? And having achieved that might we observe the prevailing paradigm (and perhaps everything else) through a different lens? Does it unmask redacted dimensions of today's equity debate? Does it in fact overturn that debate? Will we see the relationship between fundamental categories - nature, labour, capital, state - differently?

And also, can we sense from that record, in the air in the hall that day, an uncanny menace, an ill-will … a Cain measuring and measured by, an Abel?

In 1903 'systemic economic inequality' was known as ‘the labor question’ or ‘the industrial problem’. It was the question Great Britain faced when sixty percent of recruits were found to be too malnourished for military service. And was it perhaps also the question America faced when President McKinley was assassinated in 1901? The shooter, child labourer, then steelworker, had lost his job in the 'Panic of 1893'. He became an anarchist, and said he shot the President "because he was the enemy of the good people - the good working people."

In thirty years the American working class had become as poor as the British working class. The Panic of 1893 was one of a succession of crashes punctuating the 'Long Depression' of 1873-1896. Unemployment, mass protests, boycotts, strikes, riots and their suppression spread nationwide. A great Janus-faced paradox had arisen – The Long Depression from one point of view was The Gilded Age from another: wealth generation had reached historic peaks, vast new production was everywhere to be seen, but not in the slums of New York and Chicago, which were no different to the slums of London and Glasgow. Many were compelled to ask – what mechanism drives wages to subsistence levels even in the most successful economies?

The labour question is the central focus of both paradigms: Socialism and the Single Tax actually begin in agreement: Labour does not receive its full wage and the reason for this is systemic. Both agree that wages are driven down by markets, by workers competing with other workers for too few jobs. For socialists the problem is the market system, is competition itself, for competition is nothing other than a Darwinian struggle for supremacy:

“Competition is the completest expression of the battle of all against all which rules in modern civil society. This battle, a battle for life, for existence, for everything, in case of need a battle of life and death ...”

- Friedrich Engels, Condition of the Working Class in England (1845)

Thus as the remedy, the Socialist program would abolish markets, abolish competition. The State would allocate resources and guarantee jobs.

The Single Tax paradigm, on the other hand, identifies an absence of competition as the root problem. Monopoly, the pure form of non-competition, and specifically land monopoly is the underlying cause of labour's underpayment. Without land there is no production. The abolition of all taxes on production (i.e. all taxes) it is claimed, would permanently raise demand for workers, ending unemployment. Labour would acquire market power, and ‘industrial slavery’, as Henry George, the leader of the single tax movement called it, would end. The answer to the labour question is thus found within the market, an explicitly freer market.

“Abolish monopoly everywhere, put all men on an equal footing and then trust to freedom. In that way we would have the most delicate system of co-operation that can possibly be devised by the wit of man.

The fight of labour is not against capital; it is against monopoly.”

- Henry George, in debate St. James Hall, London, July 1889, from Henry George and H.M. Hyndman / The Single Tax versus Social Democracy

Schism between the two movements began in the 1880s. At that time socialism was known through events such as the Paris Commune, 1871 and the 1848 revolutions in Europe before that. Failed revolutionaries from Germany and elsewhere resettled in America and activated once more. The single tax idea, on the other hand, had evolved from the land reform movement (which runs like a thread through all of the liberal reform movements of the Nineteenth Century). It stood alongside but distinct from campaigns ranging from rent reform to land nationalisation.

Both movements were consistently vilified in the mainstream, equated with anarchy, revolution, communism and terror. These conflations blurred the two paradigms into one; nevertheless when Henry George published his analysis of the labor question, Progress and Poverty (1879), he catalysed a debate that exposed their very real differences, and it ultimately drove socialists and single taxers apart.

The expansion of the franchise to the working classes accelerated the debate. There were votes to win. In the Great Britain, the Third Reform Act of 1884 had almost doubled the voting base, now including millions of landless agricultural workers. Some of them formed political movements, two of the most well-known were the Irish and Scottish Land Leagues, both influenced by George. Indeed it was in the British Isles that the Philadelphian first became famous, making five tours there in the 1880s and 90s, speaking and debating from London to Skye, crossing swords with dukes and academics, courted by figures from the political elite. For a period, Henry George’s ideas caught the zeitgeist, and many were impelled to react.

Socialist opinion was divided: non revolutionary Fabians owed much to George’s stirring up of activist energy and they took his thought seriously. Socialist William Morris, the famous fabric designer, called him

“our friend and noble fellow worker [who] rising from among the workers, throws the glamour of his own sincerity over the most callous, and forces them to look into the misery around them.”

- Uneasy Alliance: The Reception of Henry George by British Socialists in the Eighties, Elwood P. Lawrence (1951)

Likewise, George Bernard Shaw was for a time one of the ‘really knowing’ socialists who esteemed George’s work, going so far as to declare that the Georgist solution (the single tax) would, if applied in full, achieve socialist aims.

“By his popularization of the Ricardian law of rent, which is the economic keystone of Socialism, and concerning which the published portion of Marx’s work leaves his followers wholly in the dark, Mr. George is doing incalculable service in promoting a scientific comprehension of the social problem in England.

Really knowing Social-Democrats would let George alone [because] the taxation of rent, the amount it went beyond replacing existing taxation, would produce Social-Democratic organization of labor, whether its proposers foresaw or favoured that result or not.”

- George Bernard Shaw, Henry George and the Social Democrats, London Star, June 7, 1889

Others were not convinced - “the choice has to be made between out and out Socialism and mere tinkering with taxation”. They agreed, or would come to agree, with the revolutionaries, who feared and shunned George. His fame, and his ‘superficial cure-all’ that only targeted ‘landlords’, might attract the support of capitalists and forestall revolution. In 1885 far left factions began heckling George on his UK tours. The following year George published Protectionism or Free-Trade, a declaredly liberal work, containing a critique of socialism, finding it unbalanced and counterproductive. But George never rejected - could never reject - the concept of the social realm contained within the notion of socialism. He believed in both individualism and socialism, a synthesis that is the very heart of his work:

“Individualism and socialism are in truth not antagonistic but correlative. Where the domain of the one principle ends that of the other begins.”

- Henry George, Protection or Free Trade (1886)

But this could never suffice for unquestionably, Henry George supported free market capitalism, not in spite of but as a solution to the labor problem. For many socialists there could be no return. When, only weeks after splitting with the socialists in his movement, George spoke against the actions of the Chicago anarchists, sentenced to death for the Haymarket labour protest bomb attack, it all came to a head, in an unstoppered backlash. William Morris, whose praise had once been so warm, released his scorn:

“Henry George approves of this murder; do not let anybody waste many words to qualify this wretch's conduct. One word will include all the rest - TRAITOR!!”

- William Morris, Commonweal, Nov 1887

Schism became enmity became mockery. A left wing paper reviewing one of his speeches:

“The amount of flimsy, albeit dramatic, rhetorical effervescence which he unburdened himself of, in place of arguments, to support his patent quack poverty cure, exceeded anything his fiercest opponents could have attributed to this versatile Yankee.

To those who had known or heard him in the earliest days before he had deserted the people and become a party politician and stump orator for Radical capitalists, the man's present moral and intellectual degeneracy is pitiable to behold.”

- ‘Henry George in Manchester’, Commonweal, June 1 1889 quoted from Uneasy Alliance: The Reception of Henry George by British Socialists in the Eighties (1951)

George faced enemies on both left and right. But what of the centre, the classical liberal centre from which the single tax sprang? The Liberal party in the UK was a force to be reckoned with - it had been the main party of government for the past half century - and extraordinary things were happening to it: strong factions began to follow the single tax paradigm, the land paradigm, to the root of poverty. In 1886, when the Liberals split over Irish home rule, it was ultimately a split over the land question - who should own the wealth generated on Irish land? 'Landlordism' - extortionate rack renting - figures such as J.S. Mill argued, had locked Ireland into a permanent state of near and actual famine. The Irish Land War of 1879-82, waged under the banner ‘No Rent’, attests to this. Through his writing and speaking George successfully made the Irish question - which was international news - a live case study in the single tax thesis. Clearly he played a part in the fracture and evolution of the Liberal party. He was the intellectual origin of key elements of Joseph Chamberlain’s Radical Program of 1885 and of the Newcastle program of 1891 which advocated for the taxation of land values. Although the split did damage the party - most of the next twenty years were spent in opposition - its comeback in 1906, bearing the single tax, was a landslide for classical liberal radicalism.

In the United States, parallels can be drawn: Theodore Roosevelt maintained a respectful stance towards George, he had run against him for mayor of New York in 1886, and lost. He certainly took land-centred economics seriously. On becoming president, he immediately nationalised millions of acres for parks and nature reserves, and he later wrote in favour of land value taxation. Moreover, his approach to the labor question famously focussed on monopoly, a key word of the single tax paradigm, a key word of the age. The Progressive era, generally said to begin in 1890, really began in the 1880s when Henry George re-cast land reform into voteable, progressive policy, and put it into mainstream politics in the world’s coming city. Everybody had taken notice.

“… no one could then foresee that in such a short time the movement would burst out with such irresistible force, would spread with the rapidity of a prairie-fire, would shake American society to its very foundations.”

- Frederick Engels, preface to The Condition of the Working Class in England, London,1887

1887: Henry George was at the head of the American labor movement, and the single tax was international news. U.S. socialists sought alliance. George’s party was a very broad tent, the politics of the emerging worker’s movement were still forming, and the socialists were welcomed into the mix. George hoped to win them over, and the principle that land value rightfully belongs to the community was his bridge.

“I have always refrained from accentuating any differences with socialists until forced to, regarding them as workers in the great cause of the emancipation of labor who, however superficial their views, illogical their theories or impracticable their plans, aimed at noble ends, and had laid hold of an important truth.”

- Henry George, quoted in Socialism vs. Tax Reform: An Answer to Henry George, Laurence Gronlund, 1887

And then, at the height of its success, George ejected the socialists from his party. They were stunned. Some called it an excommunication – had he been influenced by the Irish American Catholic faction, which disdained socialism? Maybe, but George insisted that it was a party issue – the socialists, he claimed, had become a ‘party within a party’. He was careful to frame the issue as a split with a particular creed of socialism - the small cadre he expelled were European-exiled Marxist activists or ‘German socialists’, as they were called.

“The term ‘socialism’ is used so loosely that it is hard to attach to it a definite meaning. I myself am classed as a socialist by those who denounce socialism, while those who profess themselves socialists declare me not to be one.”

- Henry George, Protection and Free Trade, 1886

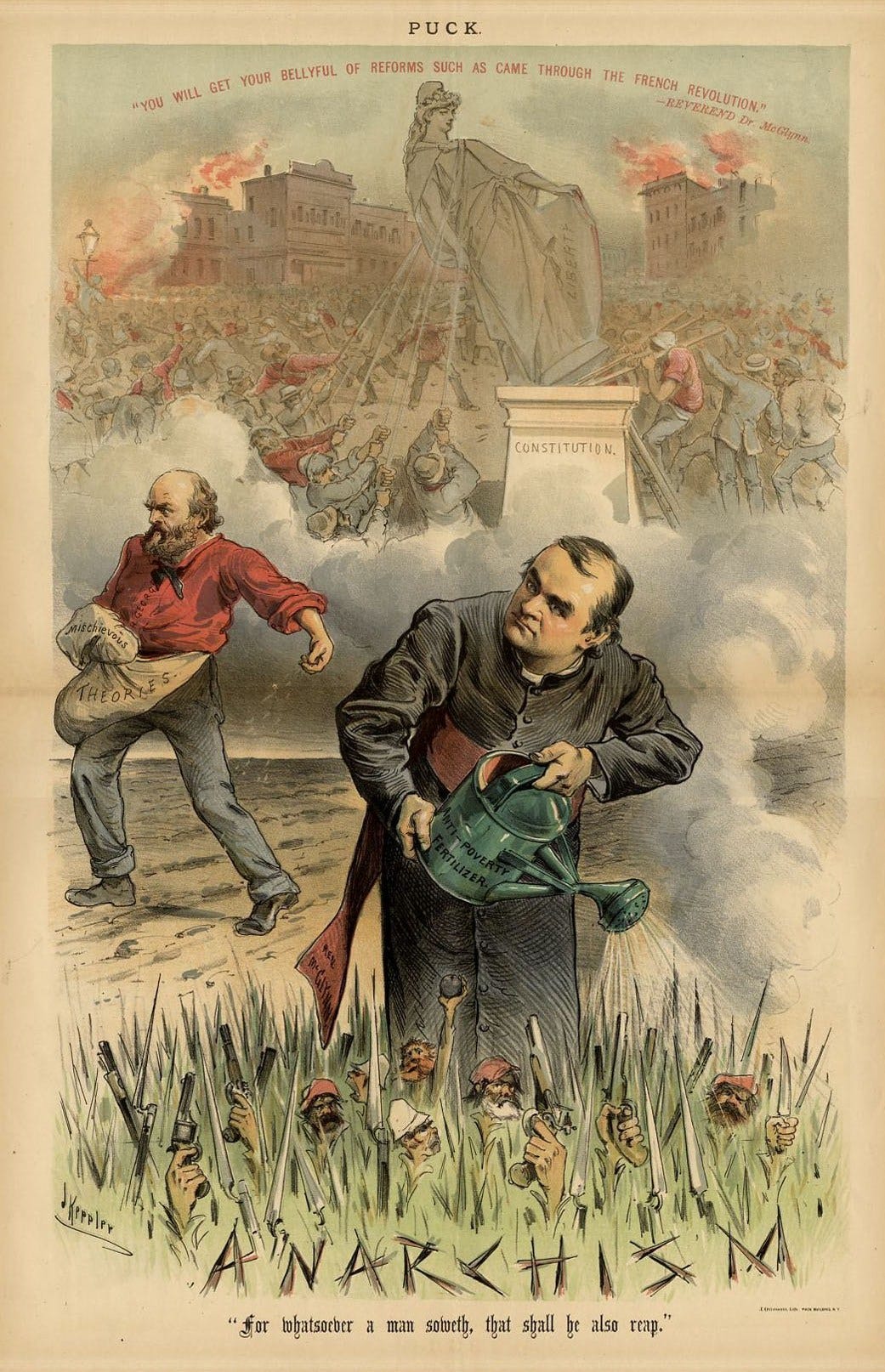

New York’s Rev. Edward McGlynn, one of George’s closest friends, a mighty co-campaigner, (both are featured in the the cartoons left and below) was less conciliatory, speaking passionately against socialism in favour of “that magnificent individualism which was a generation ago and more the chief glory of America”.

“We want no foreign socialism. (Immense applause and cheers, lasting about a minute.) We want more of American individualism! (Great cheering.)

And if we demand that certain things shall be common it is because they either have been made common by nature, or because they necessarily become monopolies, existing only by the concession of the community, and therefore, they should exist only for the benefit of the community (Cries of “hear! Hear!” and applause.)”

- Rev. Edward McGlynn speaking at The fifteenth public meeting of the Anti-poverty society, New York, 1887

George was the next speaker:

“I most cordially reiterate what Dr. McGlynn has said. (Applause.) What we have banded ourselves together for is to carry out to its full extent the great principles of liberty enunciated in the Declaration of Independence. (Applause.)

For my part I hold that we are in this neither altogether socialistic nor altogether individualistic; that there is a true and proper line at which both principles unite and fall into their proper place (applause), and, as Dr. McGlynn has said, the line is that at which any business or function becomes a monopoly.”

- Henry George speaking at the same meeting, New York, 1887

Ultimately, Single Taxers approach socialism as a form of Statism – the ideology of big government and centralised control. Statism is monopoly, the monopoly of coercion that libertarians speak of, but also of land, the root monopoly, in fact the very origin of the State.

“[Socialists] say the nation ought to abolish competition. Why you could not abolish competition without subjecting man to the worst form of tyranny – (Hear, hear and “No, no”) – and without stopping all progress. It is where competition is not permitted that there is stagnation. (Dissent, and cries of “Order” and cheers.)”

- Henry George, in debate St. James Hall, London, July 1889, from Henry George and H.M. Hyndman / The Single Tax versus Social Democracy

Single Taxers view the American revolution as the nation's foundational rejection of monopoly state power. The single tax would shrink the bureaucracy, it favours localism over big government. As the debate below shows, recognition of the significance of state power, distinct from labour and capital, is a key dividing line between the paradigms.

After the 1887 split, Socialism crystallised as anti-Georgist. In Britain, the Labour Party, formed in 1900 and lead by the single taxer Keir Hardie, did not adopt the policy. Eugene V. Debs, who founded the Socialist Party of America in 1901, abandoned his former belief that capital and labor were ‘friends’ – a Georgist truism – after reading Das Kapital in prison. He had been jailed for leading the great railway strike of 1894, his American Railway Union had been crushed. Those events live in the background of the debate below for they centred on Chicago; indeed, one of the speakers, Seymour Stedman, witnessed the violent suppression of ‘Debs’ rebellion’, there and then converting from Georgism to Marxism.

“THE CONDITION OF THE WORKING MAN AT PULLMAN”

Incidentally, the affair, also known as the ‘Pullman strike’ is a case study in the debate at hand. Pullman, a railway car manufacturer, cut workers’ pay as a result of falling orders. But the firm also happened to be its workers’ landlord, and when it declined to lower rents it sparked a general strike. The question was never more starkly illustrated – who was the exploiter – Pullman the Capitalist or Pullman the Landlord?

“The increased production of wealth goes ultimately to the owners of land in increased rent.”

- Henry George, Progress and Poverty, 1879

Debs was also influenced by Laurence Gronlund, author of The Cooperative Commonwealth, a popular, americanised interpretation of Kapital. He had been involved in the 1887 split. He said at the time:

“The German socialists who voted with the United Labor Party disavow any purpose to split that party. They want to convert it to State Socialism. It is not the breaking up of the party that we contemplate, but its perfection.

Henry George, upon whose theories the party’s principles are laid down, advocates the nationalisation of land. This we favour, but we go further and demand the nationalisation of capital also, and the abolition of all monopoly. Our ideal is a country where everything shall be centralised in the State.”

- Socialists to the Front: An Interview with Laurence Gronlund, New York Sun, 1887

This backs up George's claim that the socialist faction had sought to change the party platform. The ideal of a state super monopoly is a long way from George's correlative vision of the socialist principle as guarantor of individualism. (Note also, George did not propose land nationalisation.)

“With [the Socialists] the State is all and the individual sunk in the whole: with me the individual is the unit for the protection of which the State exists”

– Henry George, New York Sun, 1887.

It is now clear that on multiple axes – capital versus land, monopoly versus free markets, statism versus individualism, capitalism versus landlordism, wages versus rent, old Europe versus new America – Socialism and the Single Tax are radically different paradigms. The split of 1887 was inevitable, Henry George was simply the first to declare it.

By the time of the debate, the Socialist party of America was in full campaign mode - evidenced by the heightened rhetoric recorded below - gaining votes, which would peak at 6% in the 1912 presidential election. By contrast, following the death of Henry George in 1897, the American Single Tax movement had no national party and lacked the influence it emphatically had in British politics. The grass roots movement was extensive, the single tax was an established political brand, but it had delivered very little legislation. In 1895 for example, an attempt to convert Delaware to the single tax failed completely. It had been the largest campaign yet waged but the opposition deployed unwavering zeal. Later, an attempt by Populists and Georgists within Congress to give a land rent basis to the new Income tax was quickly reversed, setting the tax on an anti-worker, anti-entrepreneur trajectory. Setbacks for sure. Nevertheless, single taxers such as Thomas Shearman (author of Natural Taxation, 1897) and Max Hirsch (Democracy Vs Socialism, 1901) were re-sculpting the program to emphasise its practicality, the relative painlessness of its revolution, its modernity so to speak. Other campaigns, particularly in the west, would follow.

December 1903: Kitty Hawk, North Carolina - the Wright brothers, self-taught inventor-entrepreneurs with access to capital and land, invented a brand new paradigm for the century. It was not the first - a few months earlier, another inventor-entrepreneur, Henry Ford, formed a mass manufacture motor company in Detriot. And not far away in Macomb, activist Elizabeth Magie was patenting a new board game, designed to demonstrate the single tax paradigm: monopoly, we all learn, always wins Monopoly.

And in Chicago they debated Socialism versus The Single Tax, a power paradigm versus a technical paradigm. One lives, the other is … gone. The debate is dead. Is there any reason to hear those voices again, from the years before we disremembered?

–––––––––

Darren Iversen

December 2021 revised May 2023

(The passages following are edited down, elipses are not shown. Please refer to the source text.)

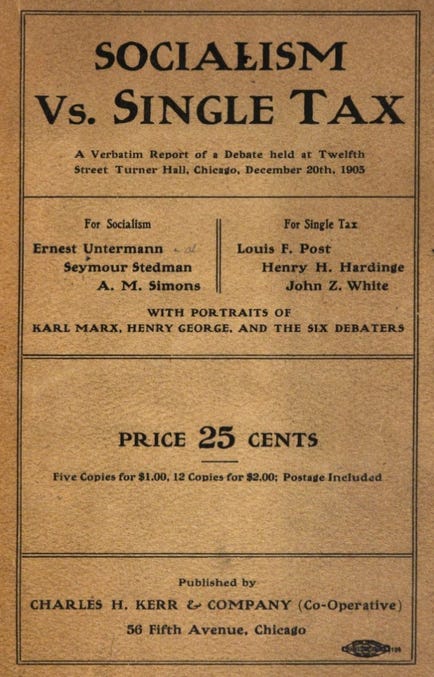

Socialism vs Single Tax

A Verbatim Report of a Debate held at Twelfth Street Turner Hall, Chicago, December 20th, 1903

The Chairman (Hon. Frank W. Jones, ex-Senator of Massachusetts):

“It is a healthy sign of the times that of a winter afternoon an audience of this size, some two thousand people, will gather to listen to dry economic questions. I have thought many times during the past few years that we were slowly drifting into the grasp of an oligarchy, but when I see an audience of this size and this intelligence leaving the comfort of their homes to listen to arguments, and arguments which appeal only to reason, I have hope.”

Resolution: "Resolved, That it is to the interest of the working class to take up the propaganda of Socialism rather than that of the Single Tax."

For Socialism #1: Ernest Untermann

(Ernest Untermann was a German-American seaman, socialist author, self declared "economic determinist". He was the first American translator of Marx's Das Kapital. Later he became a fossil hunter and natural history artist.)

“In 1880 a star appeared on the horizon with the once new idea of freeing the land by levying a single tax on it. That star was Henry George. (Applause.) His Single Tax scheme was magnified into a beautiful philosophy that would bring down justice and emancipation from the clouds. He entirely overlooked the fact that today the agricultural classes are no longer the essential element in production, but that the essential element today is the great capitalist class with its modern machine production and its great army of dependent wage workers. (Applause.) Capitalist exploitation exceeds the exploitation through land.

The Single Taxers have never said anything else, anything different, about land reform ever since Moses. If in spite of thousands of years of earnest effort to free the land, you still leave millions of the oppressed landless, there must be some fundamental mistake which all forms of land reform have overlooked.

Thirty-two years before Henry George's "Progress and Poverty" was written, a twin star had arisen in the proletarian firmament - Karl Marx and Frederick Engels found the key which opened all the secrets of capitalist production and history: The Economic Interpretation of History. In 1848 Marx and Engels expressed the greatest historical truth when they said that "The history of all societies based on private property is the history of class struggles."

Marx took politics, law, religion and ethics down from the clouds and placed them on a scientific foundation that has not been shaken since. All the leading economists of the world, capitalist and all, today use the Marxian method of investigation, although they very seldom give him credit for it. (Applause) Equipped with the Marxian philosophy of history, we are at once enabled to point out why former reforms were futile and failed, and why the Single Tax is inadequate to meet the present problem.

The victory of the working class will abolish all classes and all class antagonisms, because there is no lower class below the working class whom they might subjugate. The capitalist system will fall in obedience to the great economic and political laws to which it is subject, but above its ruins will tower the giant statue of labor, that true God of Liberty who will dethrone that lying prostitute of the dollar almighty, the capitalist Goddess of Liberty. (Applause.)”

For the Single Tax #1: Louis F. Post

(Louis Post was a prominent Georgist and had campaigned for Henry George since the 1880s. He went on to serve in the department of Labor under Woodrow Wilson, vigorously defending civil liberties during the post war red scare.)

“The first really great labor contest at the ballot box is going to be between the principle of the Single Tax on one side and the principle of Socialism on the other. (Applause.) Socialism and the Single Tax touch at many points. But fundamentally they are apart. In principle they are hostile.

There is no man that works who gets the full product of his labor. I do not have to go to Washington for statistics to prove that. All I need to do is to point to the men who get a great deal without labor. They cannot get it from any other source than from the men and women who do labor. (Applause.)

You could probably sum [the labor problem] up in two things: Inadequate pay for work, and the army of the unemployed - more men than there are jobs. The men out of jobs compete with the men who have jobs, and so wages are kept down. ... There is the sore: There is the diagnosis of social conditions at present .... (A voice, "How are you going to remedy it?")

My friend, I will come to that in time. We have to proceed in order. The Socialist remedy in substance comes down to this - organized society shall furnish employment to all and shall regulate the wages of all. That is what it comes down to, a great governmental workshop in which everybody shall be employed - (applause) - I am glad to recognize by the applause that I am stating it correctly. (Applause and a voice, "Three cheers for Socialism.")

[But] you do not begin to get any benefit whatever under Socialism until you have done all that. (Applause). Socialism is revolution, is it not? (A voice,"Yes.") The Single Tax is progressive. (A voice, "No.") Yes, it is progressive. The Single Tax will begin to yield its benefits step by step from the very start. The very moment that you abolish taxation of personal property you will begin to get some of its benefits.

The Single Taxers put land into a category alone and make capital another category. They say land is the natural source of labor products, and that man must have access to it. Having that, he can make and use capital. Not having that, he is under the control of men that you may call capitalists if you wish, but who are really landlords (Applause.) Now, we propose to abolish landlordism, for it is landlordism that is the base of industrial trouble.

The Single Taxers propose merely this - to remove the obstacles which prevent there being a natural demand for labor, that natural demand which will always keep the demand for labor in excess of the supply of men wanting work. (Applause.)

Under existing conditions, for every ten men who want to work there are only nine jobs. That is, in a rough way, our present condition - wages are bound to go down, for you have got one man out of work all the time, competing against the others. What the Single Tax men propose, is to reverse that and to open up opportunities so that there shall be ten jobs for every nine men: or more jobs than men. (Applause.) When you have that condition, you will have wages tending all the time upward toward the full earnings of the man.

One effect of taxing land value would be to remove all taxation from industry. What is the result? It makes men want to build houses. What does that mean? A greater demand for labor. But that is not all. The thing grows. As you take away land values you remove all incentive to hold land out of use.

If you get it completely done, if you bring it up to the ideal, then you have a condition in which no man will coerce labor, because labor cannot then be coerced.”

For Socialism #2: Seymour Stedman

(Seymour Stedman was a civil liberties lawyer and one time Georgist, one time Democrat who ran for Vice-President in 1920 for the Socialist party.)

“The Single Tax is simply the crowning of capitalism. (Applause.) It stands for shifting the taxes of a portion of the capitalist class upon the shoulders of another part of the capitalist class and it does not for one moment propose to abolish exploitation.

I ask the speaker who will follow me to answer, do you believe in profit? The moment you uphold profit you uphold a system of Carnegies and Rockefellers. Tell us, Mr. White, will the Single Tax abolish classes, will it abolish the economic antagonism of classes? Will it abolish on the one hand the workers searching for food and products to consume, and on the other hand the men who own and control the industries and run them for profit? Will it change the motive and the purpose which arrays these two great classes against each other?

What does the capitalist want? He wishes to pay lower wages and impose longer hours. He does not produce for utility; he does not produce for use. His interest is entirely different from that of the working class, arising from an entirely different motive in the production of wealth.

You tell us about government. Government is the police power and the force that is used by the dominant class to further its own material existence and perpetuate itself. Government will never fall until all class war disappears.

The Single Tax is not a philosophy. It is a proposed patch work for the purpose of remedying certain presumed abuses of the capitalist system. Socialism, on the contrary, is far different. We recognize certain changes which have taken place in the past and which show the evolution from savage to barbaric life, and from barbaric to civilization or capitalism, and an inevitable change into a new form of industrial existence. These changes and occurrences lead us to believe, with a great deal of certainty, that the next industrial era which will follow the present will be Socialism.”

For the Single Tax #2: Henry H. Hardinge

(Henry H. Hardinge was a precision machine tool manufacturer and inventor who had "the ability to dream-out and to work-out both fairy-like and gigantic mechanical implements".)

“Socialism is, to my mind, the unscientific protest of the dissatisfied. (Hisses.) You are taking up my valuable time by hissing. Not that I am opposed to dissatisfaction. All of the progress of the human race flows from intelligently directed dissatisfaction. But I am opposed to anything that is unscientific, because it will not work.

Mr. Stedman has said that there are very few of the great industrial combinations to-day which owe their existence to the ownership of land. Let us examine this statement.

About a year and a half ago, Mr. Schwab, who knows as much about steel as any man in this audience, went before the industrial committee at Washington. He was asked this question by the chairman: "Mr, Schwab, don't you think the steel trust is over-capitalized?" He said : "No, I don't." "Why?" "Because in the Connellsville coking region of Pennsylvania there are 60,000 acres of coal, the best coking coal in the world for steel making purposes. We have got it. We own it." You may not know what land values are, Mr. Stedman, but Mr. Schwab does. (Applause.)

In his testimony he did not say one word about steel mills, rail mills, plate mills, bloom and billet mills, blast furnaces or the various machinery and capital entering into the production of steel. What he did say was that the steel trust rested on land monopoly in the State of Pennsylvania, a monopoly given to them by the laws of Pennsylvania. (Applause.)

The Single Tax will be a tax in Pennsylvania exclusively upon land values, and the bulk of Pennsylvania land values lies in the coal beds of Pennsylvania, the cities and the oil region. The operation of the same laws that tax land values will force unused coal beds into the market, which will employ more labor, which will enormously increase the visible supply of coal, which will increase the demand for labor, which will increase wages (Applause.)

Now, as to classes and the class struggle and the class consciousness which Socialists everywhere insist upon so urgently. Classes are simply the result of institutions that make classes. Forty years ago we had chattel slavery in America. Two classes were involved, the slave owner and the slave. With the abolition of the institution of slavery both classes went by the board, and the only way to destroy present classes is to destroy the institution on which they are based - land monopoly. This the Single Tax will do.

When you destroy land monopoly and make opportunities free to all men, how much freer can opportunity be under Socialism or any other ism? Land is the basis of all production, and if you are the owner of the land you can control the people. Unless you solve this problem you cannot solve the social problem.

If you own the capital and I own the source of capital I will control. The Single Tax will destroy the private ownership of the earth in the only intelligible, practicable, simple, scientific and just way that it can be destroyed, and it will work, and that is why the landlords fear it.

You Socialists have got to deal with this question of taxation. You have to meet it. You cannot abolish it without abolishing all government. I am not opposed to government; I am not an anarchist, nor yet are you. What will you do with it? You have got to deal with it. There are only two things you can tax: one is labor and the other is land monopoly. If you tax labor as it is now taxed, by taxing personal property, and everything in sight produced by labor, you will do the very thing that brings about our present industrial problems, the very condition you wish to destroy.

We want co-operation; so do you, and we know how to get it. We want it to be voluntary and universal. We know that men co-operate because it is natural and necessary, and if you remove the trinity of burdens, prohibitive land values and taxes upon production and exchange, you will at once make production perfect, unlimited and universal; and the moment you do that you will have the free industrial system that the world today is looking forward to. (Applause.)”

For Socialism #3: A. M. Simons

(A. M. Simons was a journalist and believer in ‘scientific socialism’. He vehemently opposed Lenin's regime and eventually became a Republican.)

“We are not interested in the squabbles between these wings of the capitalist class. Today we find that the continued slavery of the working class rests upon the perpetuation of the quarrels between their masters, and it is for that reason that we antagonize the Single Tax, because we see in that an instrument to weld the chains firmer upon our wrists. We see that the struggle is pushing forward on a clear field between capital and labor.

I say that you have no right to define liberty for those who chance to belong to the working producing classes. Under Socialism there would be a different definition. The class that would do the defining, that would decide what was right and wrong and what was liberty, would be the great producing class of the world. (Applause.)

The Socialist shows you here that the interests of the working class are in everlasting war with all forms of exploitation, whether of the landlord or the capitalist. (Applause.) The working class of the world have shown that they care very little for the Single Tax. (Applause.) And today when you look over the entire capitalist world and you see the gathering hosts that are following the red flag of Socialism; when you see them lining up all over the world, when we see the mighty fight that is coming, it is at least a consolation to know where our enemies are.”

For the Single Tax #3: John Z. White

(John Z. White was a Single Taxer, author and speaker, estimated to have lectured ten thousand times.)

“’Historic changes in society flow from changes in the economic basis.’ Marx said so, Engels seconded the motion, the International Association voted unanimously, and that settles that. This sort of history is not good history. No man in this audience is determined wholly by his material surroundings.

Some men are largely determined by material affairs. Some men are determined almost entirely by emotions, and I am sorry to say that my experience has been that the Socialist groups in Chicago are a complete confirmation of the latter assertion. (Laughter.)

I notice that the appeal this afternoon is made to the emotions, made to the sentiments. (Laughter, and a voice, "Tell us something about the Single Tax," and hissing.) I am doing the talking now. (Applause.) I want to find out whether I am to be put behind bars metaphorically or not. This is my turn; and the minute you overstep that line, gentlemen, you furnish me with the chiefest argument against your system. (Applause.) This is not the first of this sort of interruption. I have met it before. I scorn a man who is not square. I despise a man who is not square.

I insist that governmental control, public control, of all industries will remove the force that is necessary to carry material civilization to its greatest height - that of individual initiative. Free competition is absolutely necessary to remove tyranny. I want to remove tyranny, but I insist that it is not necessary to destroy individual ambition in order to accomplish that result. (Applause.)

Capital does not last. Land does. All through history labor has been held in subjection. What held it? Something that lasted all through history, and something that still continues. What is it? What things have continued in all the history of humanity? Two things, man and the globe on which he lives. (Applause.) To hold man in subjection you will have to either enslave his body, or hold the land on which he must live.

There is the dividing line. The ancient landed aristocracy is now in control - (applause) - today, as in the ancient time, it is the landed interest, no matter in what guise, that dominates the economic situation everywhere.”

THE END

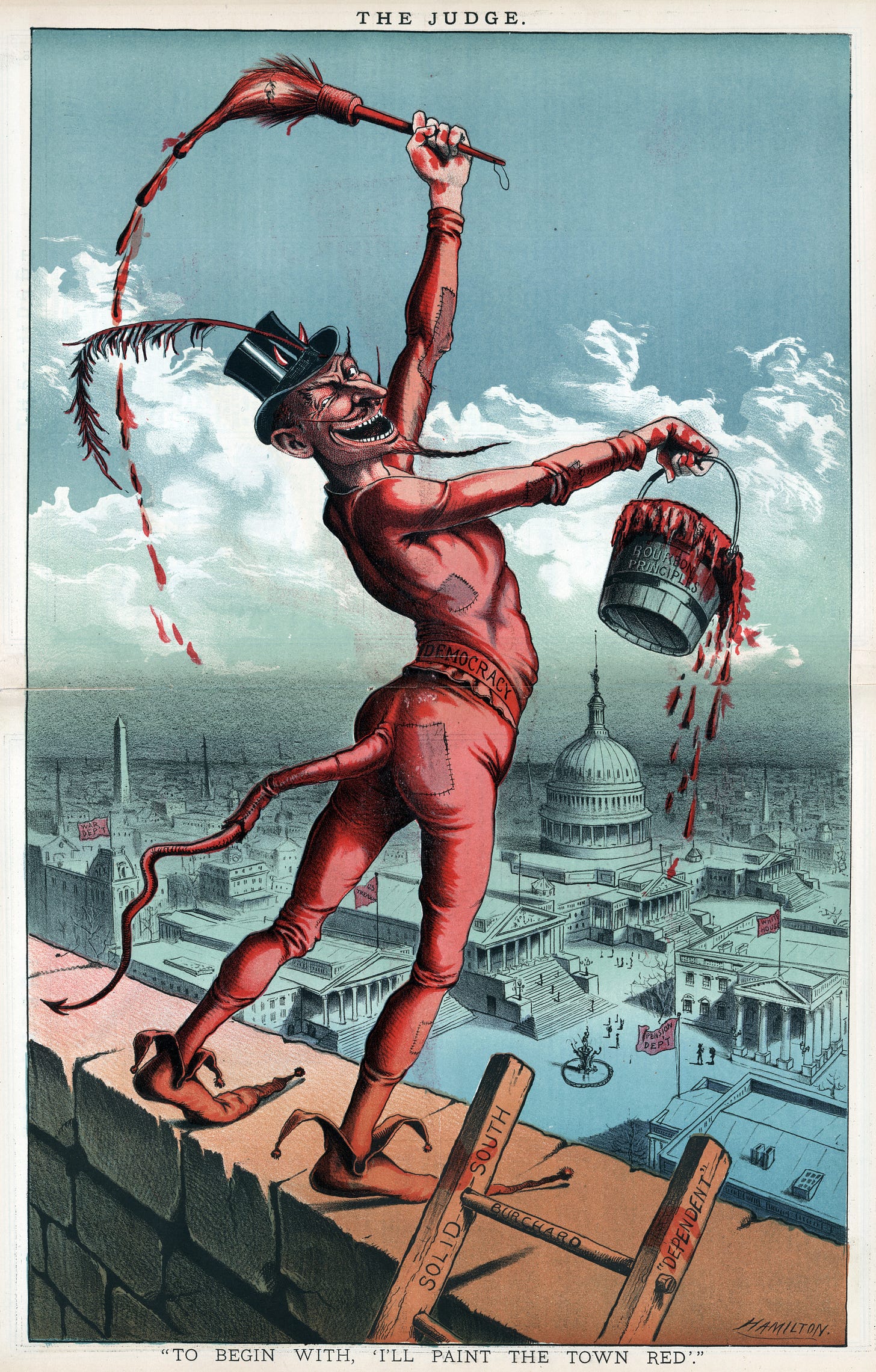

First cartoon: The Judge vol. 7, 31 January 1885

Second cartoon: PUCK, 1887. (Henry George and Rev Edward McGlynn campaign for the Single Tax)

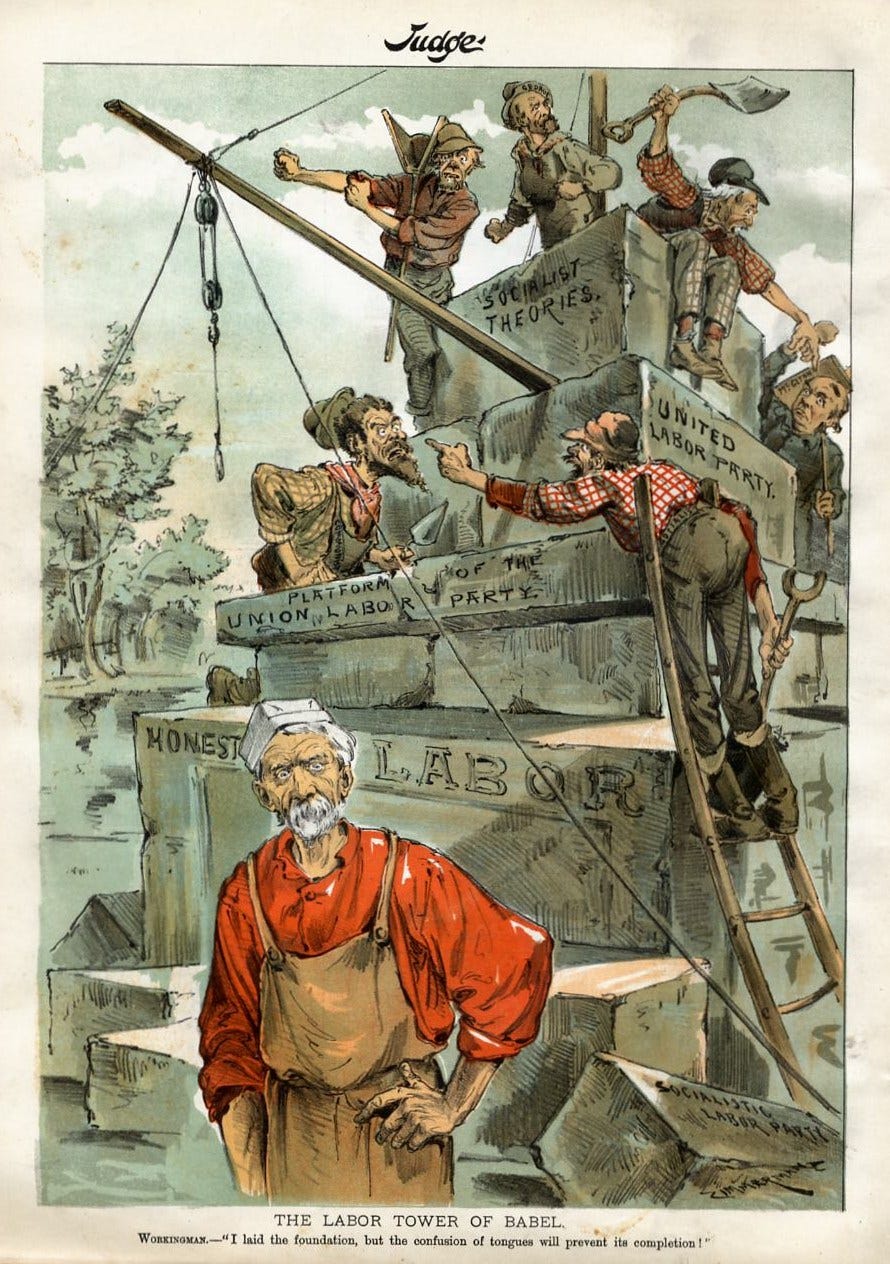

Third cartoon: Judge, 1887. THE LABOR TOWER OF BABEL

Three links to the full debate transcript:

Edit 5 July 2025:

This confirms the date as 1903 - some sources say 1905.