The Single Tax v World War One (12) April-May 1912

“Wild excursions into a bastard kind of Fabian Socialism”

The centenary of the Great War occasioned many lectures on the origins of the war. We have previously noted expressions of dissatisfaction by historians with the historiography of the subject. We have noted certain absences, for example the downplaying of the “domestic cause” theories of the 60s and 70s which uncovered “pre-revolutionary situations” in all of the countries in question. Today’s mainstream opinion, it seems, is quite different:

Historian: “The whole period from 1912 to 1914 was a very quiet one”

(see also 53:42: “I do not have an answer”)

This series has highlighted a unanimous forgetting of the debates and conflicts arising from the advance of the land issue into government. Lloyd George’s Limehouse speech, and the Budget of 1909 are of course not forgotten, but their core message and purpose has been. But it can be found in the public record of the parliamentary debates: the leader of the opposition in Parliament explicitly acknowledged the gravity of the debate:

“We are asked, for the first time, to look at the origin of property.”

The Single Tax debate was clearly an issue in its own right, but it arguably also had a close relationship to other of the great conflicts of the age such as Irish Home rule, which drove some of the Lords to paramilitary agitation against the Liberal government. Had the land war, in the partial guise of something else, returned once again to Ireland?

The material in this series supports George Dangerfield’s picture of deep polarisation arising from the consequences of mass democracy. Look again at the language in this previously quoted clip:

Historian Margaret McMillan is aware of these facts:

“There certainly was a sense among the upper classes in Europe that … a war would be a good excuse to get rid of things that they found irritating like a constitution and like unions and like free speech”

She is also aware that in the weeks prior to the war, the UK was facing possible civil war:

But these facts fall quickly to ground - they are outside paradigm and thus do not assemble into an alternative picture, the Land Values perspective.

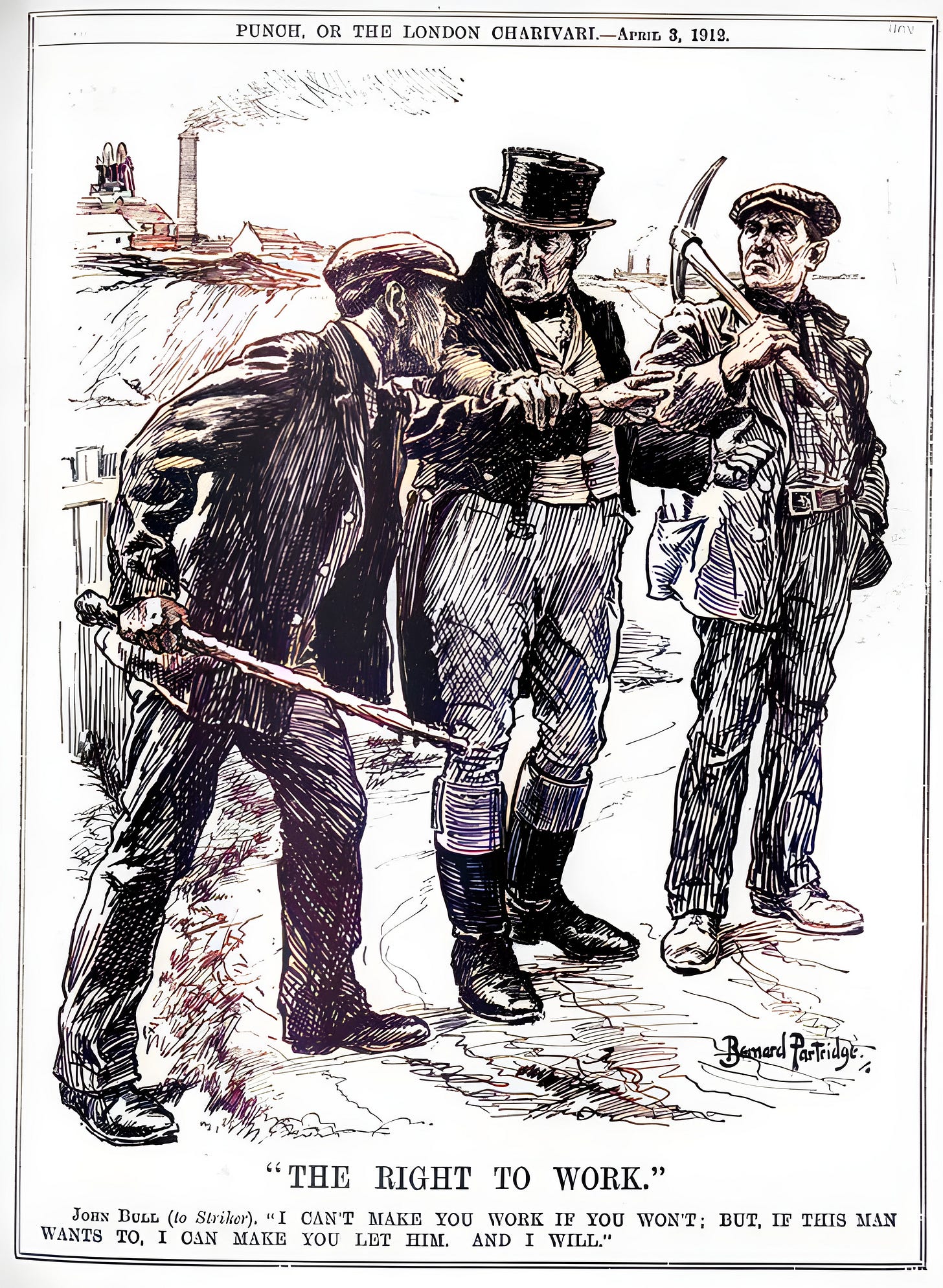

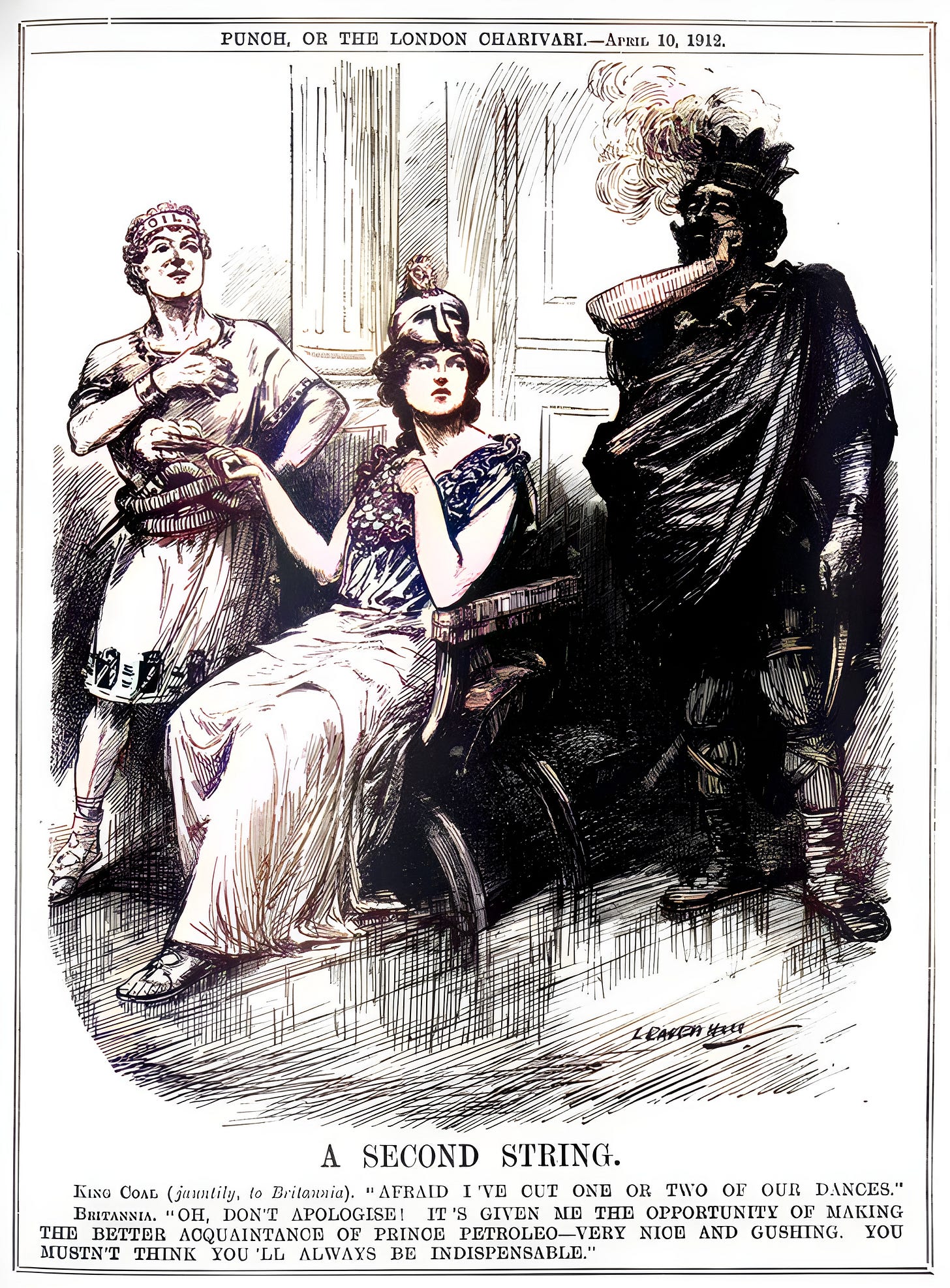

In 1912 coal was still king. A national coal strike could stop the country. The government must act quickly.

“The dissatisfaction on all sides is too keen and the recognition of the injustice of the existing social order is too widespread for any permanent peace.”

“In land valuation and Taxation of Land Values the Government have the solution in the hollow of their hands.”

“The miner and the other over-worked and underfed millions want their place in the sun”

“The mining question, like the housing question, is but a different name for the land question”

A moment of truth

Could the government use the strike as a reason to drive through Single Tax reform? Would that have been wise in 1912? Would it be met with para military resistance from the Lords? Was the ultimate goal, the abolition of unemployment, worth that?

The heat from an ever more possible Single Tax future was felt and the response was to back away. The land issue was sent to Committee.

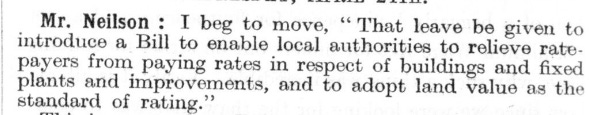

Emphasis was placed on land value taxation for local government, an issue with an established bi-partisan record in parliament.

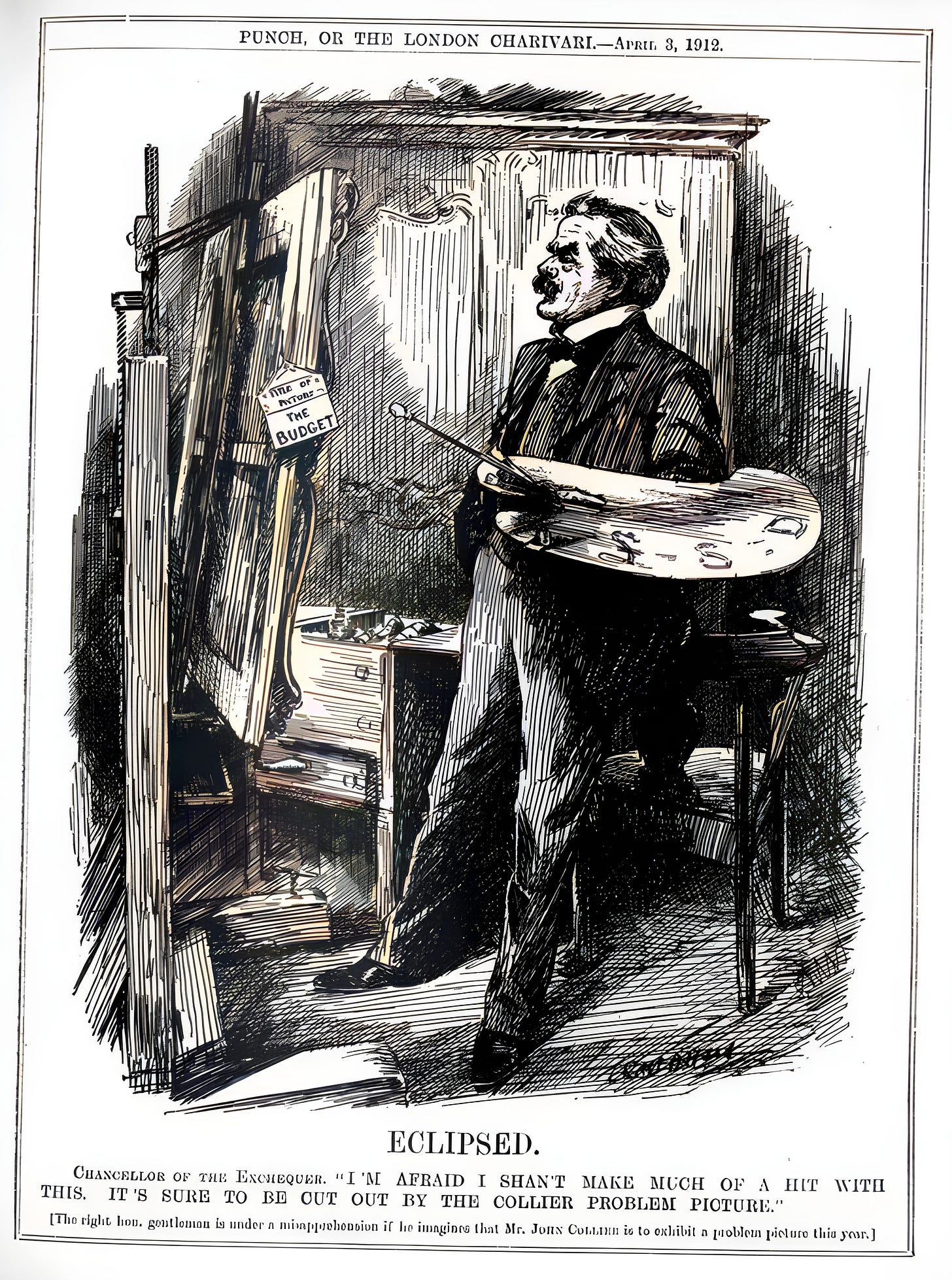

The panic to end the Coal Strike gave rise to many debates in which the Single Tax perspective was voiced: any measure other than land value taxation can only be a palliative. The Welfare State was formed in the glare of that critique, and it was authored by the people most aware of it.

THE ORIGINS OF THE BRITISH WELFARE STATE are usually attributed to the threat to the Liberals of the new Labour party in the House of Commons, to the evolving radicalism (or at least class consciousness) of the workers manifested by their demands for the overhaul of existing institutions for the care of the poor, and to the presence in the cabinet of David Lloyd George and Winston Churchill.

The force of political competition, it is argued, came from the left. The Liberals responded with social reform.

These traditional explanations are not, to be sure, wholly wrong. Labor, of course, did have an impact. The Webbs were influential, although not with Lloyd George. But as is usual with simple historical explanations, they are less than half-right.

The bundle of legislation and legislative proposals usually taken as the Lloyd George welfare program did, in truth, arise from political challenge, but it was a challenge from the right, not the left.

Insurance pensions were a detour in Lloyd George's reform program, a tactical step in the revival of Liberalism. His main and continuing interest remained land reform and development.

At the core of nearly every proposal lay what was then termed site-value taxation. This meant essentially the separation of the value of any improvements in a land parcel from the value of the land itself for purposes of rating and property tax. The potential impact of such a method of rating could bring sunshine into the life of even the most discouraged socialist.

- Bentley Brinkerhoff Gilbert, David Lloyd George: Land, The Budget, and Social Reform, The American Historical Review (Dec 1976)

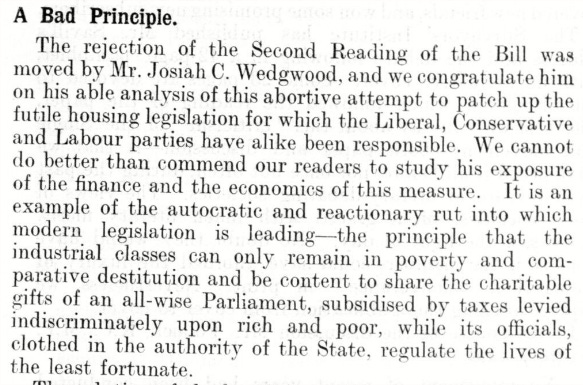

“the autocratic and reactionary rut into which modern legislation is leading”

Media

The Single Tax was Liberalism’s best hope to check the growth of the State.

The State: “an incorporeal entity in a condition of chronic bankruptcy”

“wild excursions into a bastard kind of Fabian Socialism have hidden and all but strangled the true work of Liberalism”

Yuan Shi Kai, President of China, Single Taxer

Read the following editorial. Land Values is arguing that the root cause of the Great Unrest was the Land Campaign’s effect on class consciousness. Workers had had contact with the grass roots land campaign, had understood Lloyd George’s speeches, and the Georgist perspective on unemployment, encapsulated in the now disused term, Landlordism. The effects of land monopoly were everywhere, as rural populations continued to crowd into the cities. Wages were driven down, rents went up; living-space per person shrank - housing conditions were appalling, as we shall see.

On the other hand, this was also a time of outstanding innovation: aeroplanes were now dotting the sky, motor cars and communication cables were transforming roads and mental horizons. A proposal to recast the tax system, based as it was on solid intellectual foundations, and now being tested in the Commonwealth, was merely typical of the age. It is no surprise that voters gave it four successive mandates.

The Liberals had claimed that unemployment and underpayment could be fixed at root, by legislation. In the face of constitution-wrecking resistance they had failed to deliver. In a terrible Catch 22, the Welfare State was invented as compensation, and as a result the Liberals had allowed Land Monopoly to escape. One only imagines that Lloyd George was digging in for a much longer campaign. On the horizon was the promise (or threat) of the results of the Great Valuation, the first necessary step towards Land Value Taxation.

“The industrial army that was preparing to march against the common enemy has been left to engage in a general warfare of strikes with secondary foes, and now labour fights capital, whilst monopoly, secure and unscathed, Caesar-like looks down upon the gladiatorial show”

“Those who scented ‘revolution’ in a measure of just finance, have been compelled to legislate in panic because the workers have determined to wait no longer on politicians”

“a universal minimum rate of wage would be established by economic law”

“Part of the childhood of the sun!”

“Out of the grip of death he brought you”

When does it start?

The early history of the corruption of Economics

“100 Reasons for Taxing Land Values”

“Let us carry our respect for property rights to its logical conclusion”

Despite the hurried slide towards welfare statism, Lloyd George attempted to revive his land campaign, this time focussing on rural issues. He understood that low rural wages were driving workers into the cities, and driving down urban wages. As the Daily Herald observed, the Chancellor had learned the maxim “When in doubt play Land Reform”, because it was clearly popular with voters.

Miss Ponking’s “door to door mission work”

G.K. Chesterton’s mental horizon

Land Values’ comment:

“By taxing land values only and untaxing industry we shift the burden of taxation from the worker to the idler.”

“These people are inciting the masses, through a sympathetic Government, to commit one of the greatest crimes ever committed by a majority against a minority”

“Mr. Hamilton’s magnificent motor van”

Poverty is a legal phenomenon

Mr Wedgwood (single taxer):

Sir W. Byles

Mr R. Lambert

“Capital is nothing more or less than stored up labour working on the land”

Mr Percy Harris

The Valuation to be accelerated - expected before 1915

Mr Booth

Three decades before George Orwell’s Down and out in Paris and London, American novelist Jack London (author of Call of the Wild) wrote The People of the Abyss (1903). It was a first hand account of poverty in the UK, focussing on London.

- George Dangerfield

The author sampled poverty in London’s East End, known then as The City of Dreadful Monotony. His account accords with the passages quoted above, with Charles Booth’s Life and Labour of the People in London (1889), Seebohm Rowntree’s Poverty, A Study of Town Life (1901), which Lloyd George consulted frequently. The hyperbole of his Limehouse and Newcastle speeches, so widely admonished, was grounded in the reality described in these books.

“a constant elimination”

“a subter-bestial existence”

400 cubic feet - the price of space

Rent - the great predator of wages

“from the land rises the hunger wail”

The English, a people who live “by toil at colossal artifices”

And the statistics of mortality, especially of infant mortality, show that in the richest communities famine is constantly at its work. Insufficient nourishment, inadequate warmth and clothing, and unwholesome surroundings, constantly, in the very centers of plenty, swell the death-rates.

What is this but famine—just such famine as the Irish famine?

It is not that the needed things are really scarce; but that those whose need is direst have not the means to get them, and, when not relieved by charity, want kills them in its various ways. When, in the hot midsummer, little children die like flies in the New York tenement wards, what is that but famine? And those barges crowded with such children that a noble and tender charity sends down New York Harbor to catch the fresh salt breath of the Atlantic—are they not fighting famine as truly as were our food-laden war-ship and the Royal Prince’s gunboats? Alas! to find famine one has not to cross the sea.

- Henry George, The Irish Land Question (1881)

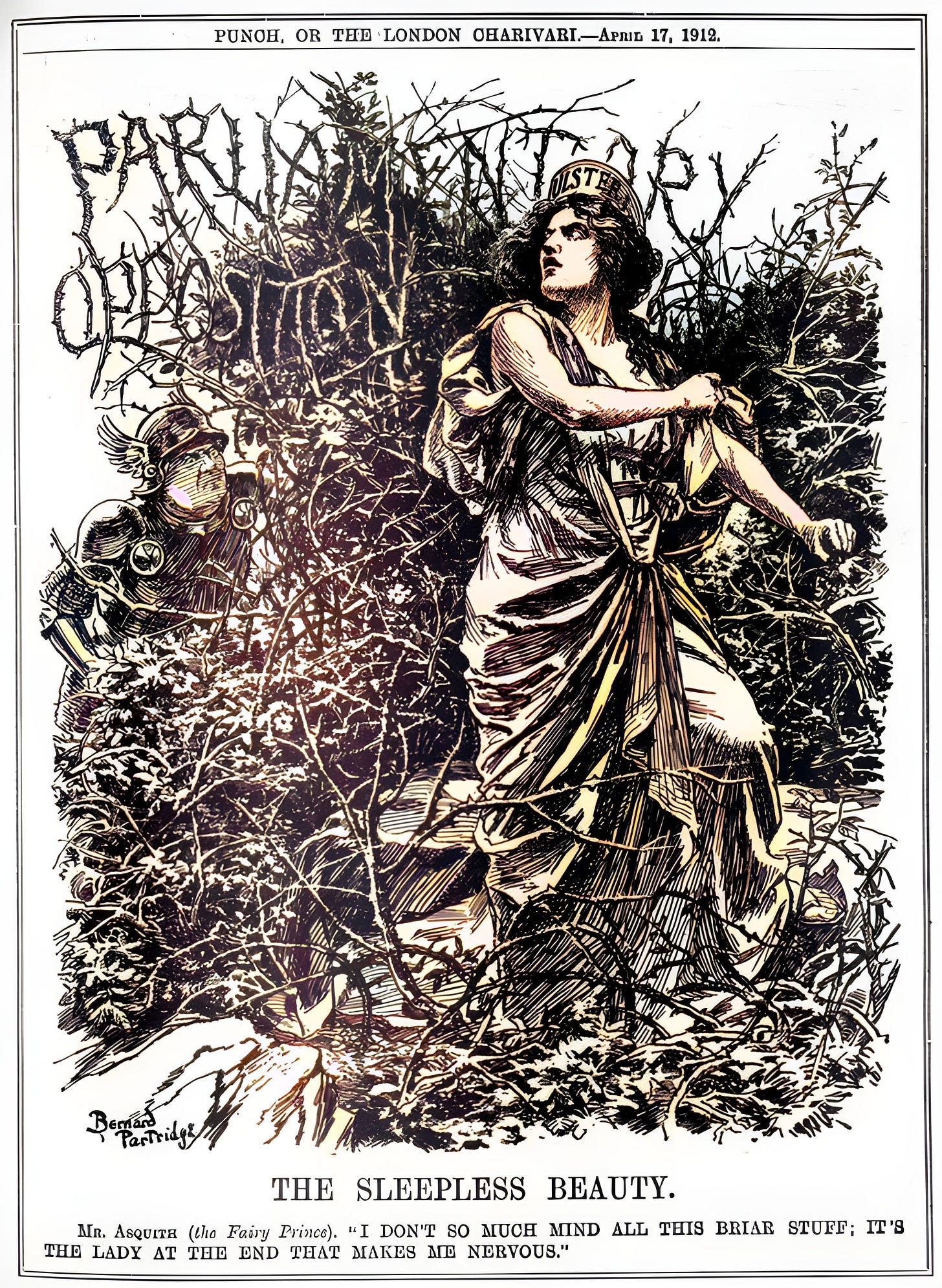

“Parliamentary Opposition”

“Under the Taxation of Land Values none will escape.”

“one lesson stands out in bold relief: the change that has come over the face of British politics”

To give the vote to people who must beg or steal or starve, to whom the chance to work is a favor — this is to invoke destruction. To put political power in hands embittered and degraded by poverty is to wreak havoc.

- Henry George, Progress and Poverty, chapter 42, How Modern Civilization May Decline (1879)

“If the Government will not fulfil the hopes they held out of going to the root of the poverty problem … they are going to be driven along the lines of restriction and that way lies the end of all things, at least for Liberalism.”

“The advance of rent is an enduring obstacle to higher wages.”

“the frozen feudal sources of monopoly were to vanish before the rising sun”

“When the Taxation of Land Values is debated in the House of Commons today the Government is dumb.”

“It was the Land Clauses of the ‘People’s Budget’ that saved the party from defeat”

“The progress of Socialism has startled the most apathetic. The progress of Liberalism has been checked; the forces of reaction have been strengthened.”

“This doctrine of equal rights to the use of the earth is graven upon the face of Nature”

“In handing over to one man that element upon which, and from which, other men must live we make him their ‘master’ in the fullest sense of the term.”

“It is private property in land which is the root cause of the acute distress which prevails among the working classes of every country to-day”

“it is this that causes the intense struggle for a bare living”

“What is the matter with labour all over the world to-day is that labour is robbed, and any remedy which stops short of abolishing that robbery is futile.”

What I contend for is this: That it is a mistake to consider the Irish Land Question as a mere local question, arising out of conditions peculiar to Ireland, and which can be settled by remedies that can have but local application. On the contrary, I contend that what has been brought into prominence by Irish distress, and forced into discussion by Irish agitation, is something infinitely more important than any mere local question could be; it is nothing less than that question of transcendent importance which is everywhere beginning to agitate, and, if not settled, must soon convulse the civilized world—the question whether, their political equality conceded (for, where this has not already been, it soon will be), the masses of mankind are to remain mere hewers of wood and drawers of water for the benefit of a fortunate few? whether, having escaped from feudalism, modern society is to pass into all industrial organization more grinding and oppressive, more heartless and hopeless, than feudalism? whether, amid the abundance their labor creates, the producers of wealth are to be content in good times with the barest of livings and in bad times to suffer and to starve? What is involved in this Irish Land Question is not a mere local matter between Irish landlords and Irish tenants, but the great social problem of modern civilization.

- Henry George, The Irish Land Question (1881)

“On the Taxation of Land Values he describes himself as a whole-hogger”

“Send 100 copies to my agent.”

Sun Yat-Sen, Single Taxer

“The teachings of your single taxer, Henry George, will be the basis of our program of reform.”

“the Single Tax is only another name for economic freedom, without which no social problem can be solved”

“The Single Tax opens the door to human progress. It is liberty”

In the Parliamentary debate on land nationalisation the proposal got no support from Single Taxers.

Mr Barnes: LVT - “But we are a long way from that.”

“The people I represent in this House are the single taxers of this country”

“sops to keep us quiet and to prevent us getting to real business”

“We want a plain, simple proposition for destroying the power of land monopoly.”

“There is no single taxer who does not hate this Bill and hate the idea of land nationalisation”

“it merely sets up a new landlord in place of the old landlord”

Land nationalisation: “does nothing whatever to stop the exploitation of labour”

Mr Pretyman: “The valuation stands condemned … the whole basis of the valuation is gone”

Lloyd George’s National Insurance bill was not only unpopular with whole-hogger Single Taxers, it was also unpopular with workers, who did not welcome compulsory wage deductions. In fact, this was the first time the lowest paid workers were subject to direct taxation by central government. Both Liberal and Labour candidates lost to the Tories in several by-elections. The British Medical Association called the policy a “long step down the road of Socialism”.