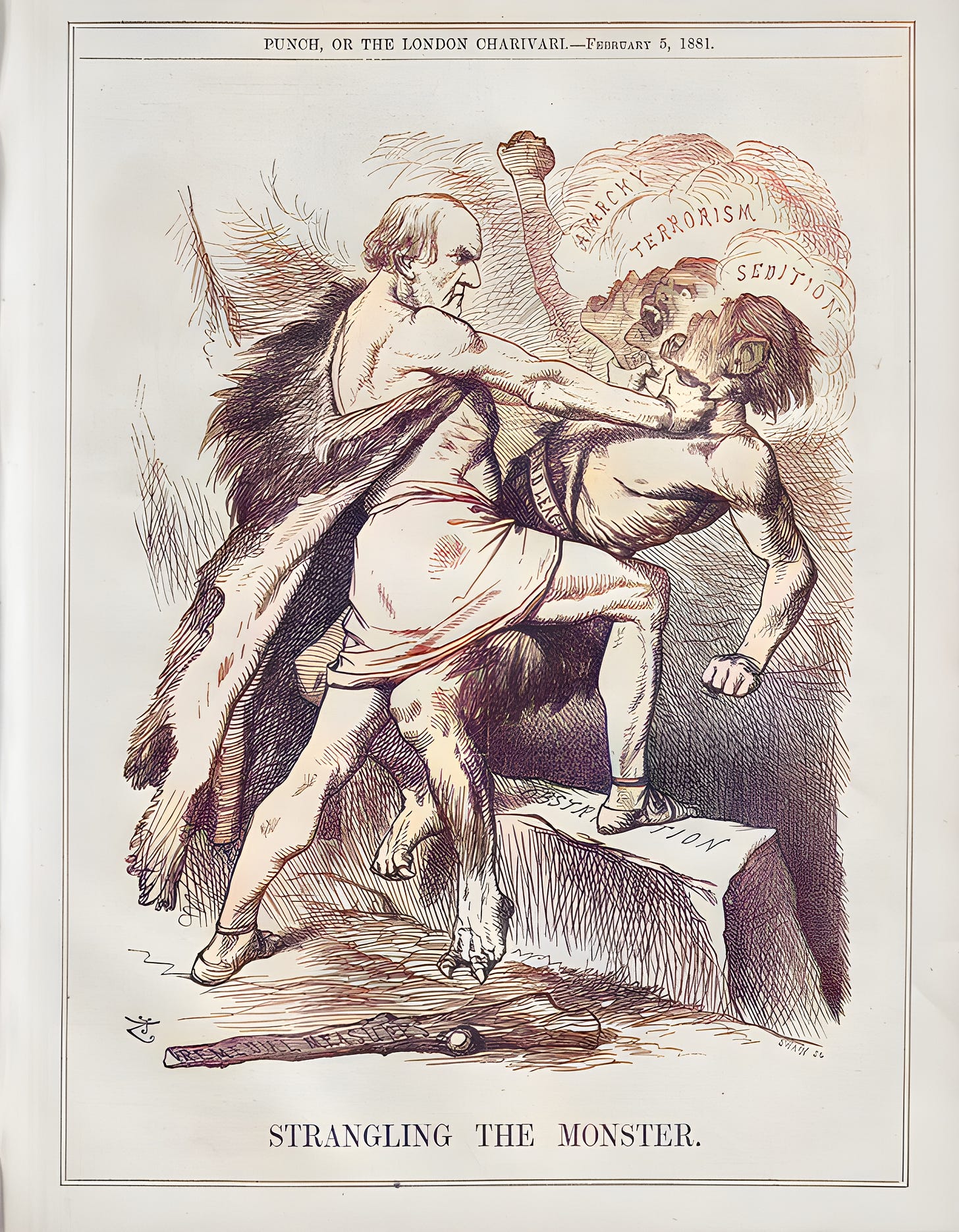

The Single Tax v World War One (8) September-December 1910

“For once the ideas and forces of revolution have got law and order on their side.”

“The Chancellor, in his rendition of the famous Land song, gave its full site value to every note.”

“Not one cause, not one factor, not one person, and not one country.”

It was noted in part one of this series that historians of the Great War are unsatisfied with the historiography of the war’s causes - the complexity of events seem to overwhelm the best academic tools. Professor Margaret McMillan, author of The War That Ended Peace: How Europe Abandoned Peace for the First World War (2013), was interviewed by the New York Times:

But despite the thousands of documents, diaries and histories of the period, there is still no historical consensus about the origins of the war, and particularly about who is to blame for it. “The consequences were so great, but we still don’t understand how it started,” she said.

Everyone agrees about World War II. “There may be disagreement on the margins, but not on the cause,” she said. “We don’t have that in the First World War.”

Professor McMillan argues that there is no simple or single explanation for World War One. Perhaps, in the end, it was “nobody’s fault”, it was “one of those things that happened”, a “slithering over the edge into the cauldron of war”:

McMillan (who also wrote The Uses and Abuses of History, 2008) offers a multi-factor theory to explain the war - it was a “perfect storm”. But her expansive, inclusive survey omits the UK Government’s multi year battle to start a Single Tax revolution. It omits the international land reform movement, which was making legislative progress in the British Empire, America, Europe and elsewhere. As this series is demonstrating, that movement was real, it had mainstream philosophical roots, its own history, and it directly critiqued the economic foundations of the aristocracies who ruled the Great Powers.

Professor McMillan is the great granddaughter of David Lloyd George. Her maternal grandmother, Lady Olwen Carey Evans, was Lloyd George’s daughter. At this moment in this survey, Lloyd George is fighting to begin the re-structuring of an Empire’s governmental system. His aim is to abolish unemployment and promote economic freedom independent of government. He is opposed by the British landed class - at this moment the most powerful elite in the world, connected by blood to the aristocracies of all of the Great Powers.

In less than four years they would all be at war and a generation of land reformers would be wiped out.

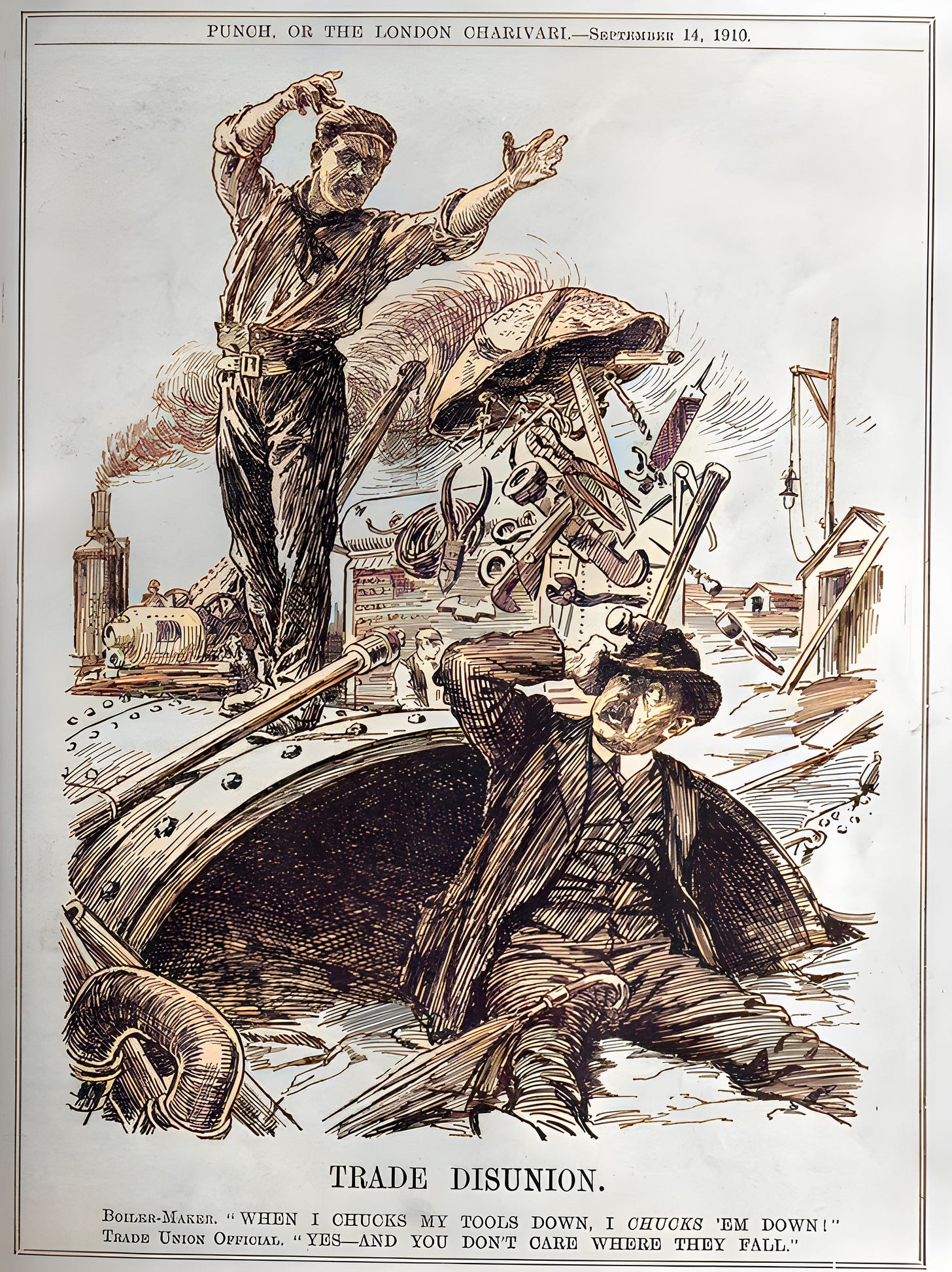

The “great refusal” of 1910

“The rise of European civilization is too vast a subject to give proper perspective in a few paragraphs. But all its main features, and all its details, illustrate one truth: Progress occurs to the extent that society tends toward closer association and greater equality.

Civilization is cooperation.”

- Henry George, Progress and Poverty, Ch 41 The Law of Human Progress (1879)

Nineteen Ten was a year of negotiation. The tone changed: Lloyd George’s 1910 budget speech contained no denunciation of landlordism, no scathing poetics. The hard line would be to require the King to promise to create enough Liberal peers to ensure a majority in any vote in the House of Lords, but the sudden death of King Edward had given rise to calls for a truce.

The time was appropriate to “lay party passions aside, to sign a truce of God over [Edward VII’s] grave.” … Lloyd George was “much impressed” by this idea …”

- D.M. Cregier, ‘Bounder from Wales’, Lloyd George’s career before the First World War (1976)

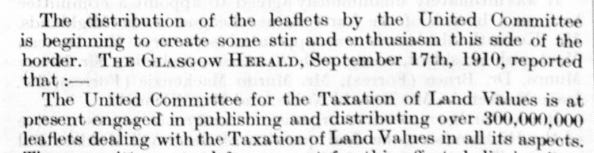

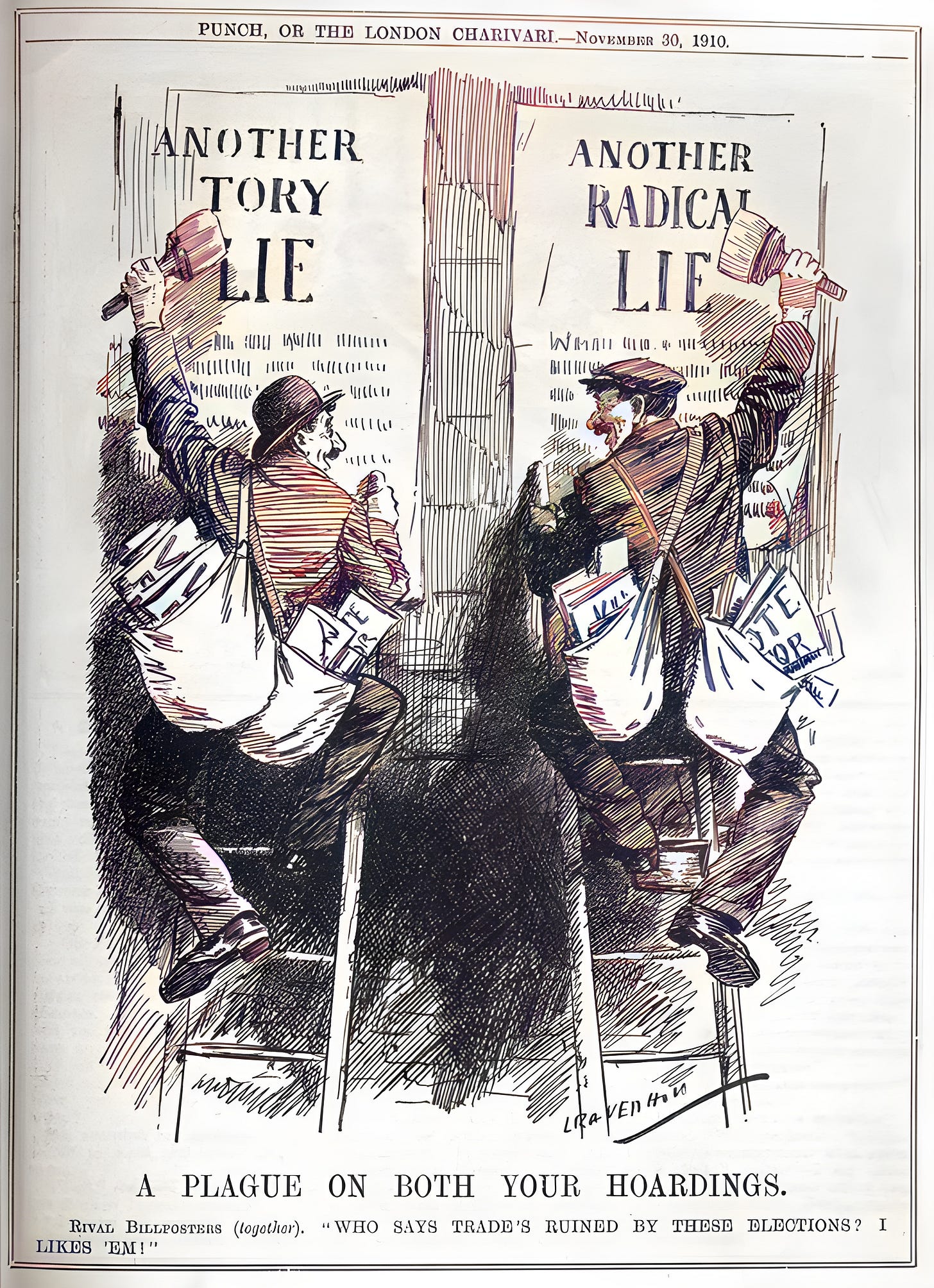

It was the Chancellor who put most effort into conciliation. Many Tories remained belligerent, believing that the government was faltering, but Balfour and Lord Lansdowne assented to Lloyd George’s proposals, and a series of confidential Liberal-Tory constitutional conferences were held to discuss the future of the Lords. Twenty two meetings took place - both leaders, Asquith and Balfour, desired a solution: the anti-Single Tax counterrevolution had leveraged the land debate to force an election, but that election had now added the break up of the Union (Ireland) to an already volatile brew.

The Chancellor may have decided, during these crisis months, that the a Single Tax UK was best treated as some way off, for in the new Budget he proposed a National Insurance Bill - a Welfare State palliative, not consistent, he surely knew, with Liberal-Georgist principles. But Lloyd George had already secured a very valuable thing - the national land valuation, the new Doomsday Book. Equally valuable was the likelihood that the Lord’s would lose the power to block tax legislation. For a legally and democratically enacted revolution, that was undeniable progress.

Returning from a break in the Welsh hills in late summer, Lloyd George, encouraged by the “bi-partisan harmony” of the constitutional conferences, proposed a coalition government, to address “an accumulation of grave issues” regarding “the highest national interests”. In his memorandum he argued that a coalition would enable the “most progressive and un-prejudiced elements in each party” to prevail. He identified twelve issues to be addressed, one of which was “land”.

From a Single Tax perspective, one could interpret Lloyd George’s informal conferences and coalition ideas as providing him, and his colleagues, with a suitable platform for arguing the single tax case. Single Taxers believe that it is the root reform. One senses from evidence already presented that Balfour (Tory leader), perhaps, thought very deeply about this.

“A synthesis is a reconciliation and resolution, a harmonious blending of the best of what appear to others to be clashing forces. It is part of George’s genius that his proposals do just that, they solve one problem by resolving it with what ordinary minds had perceived as another problem. They turn two problems into one solution. That is what George means when he, observing this marvel, insists so often that “the laws of the universe are harmonious.” Good ideas and good policies support and reinforce each other, like dovetailed corners.”

- Mason Gaffney, on Henry George, in Full Employment Through Total Tax Reform (1993)

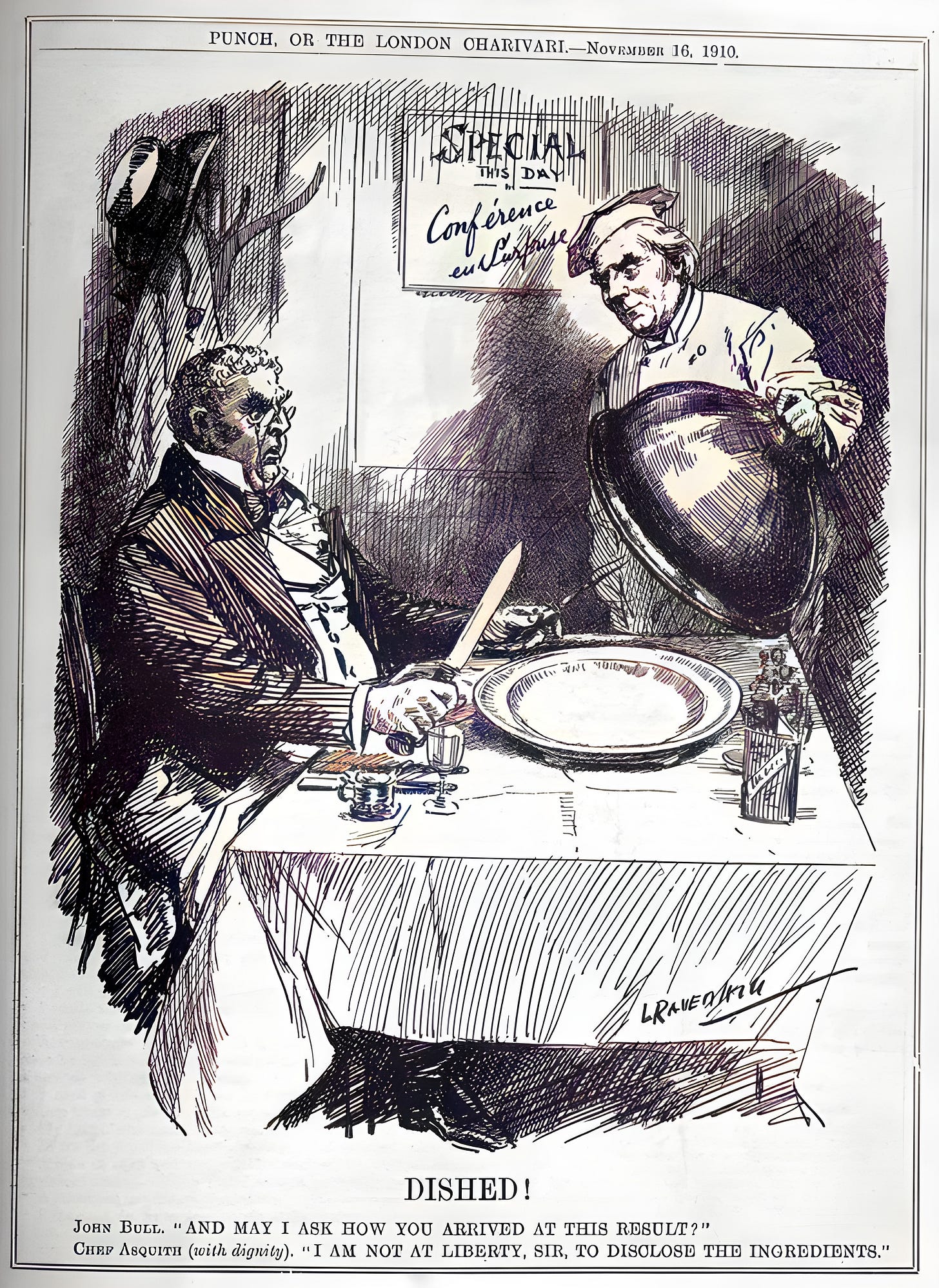

But synthesis did not happen. The land reformers in the Liberal party were against coalition, as were the hardliners in the Conservative party. Lloyd George called it the “Great refusal”.

Negotiations quickly returned to the original issue - the right of the Lords to reject money bills. They did not last long, they fell over the original question - what is a money bill? Is the introduction of a new principle of taxation within the scope of a money bill?

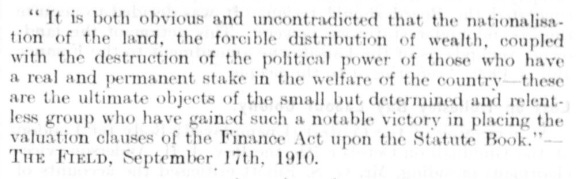

The Liberals asked: can a democracy function if an unelected body is able to prevent government from funding itself? The Tories countered: can democracy result in the state persecution of a minority class (even a privileged one)? Corinne Comstock Weston has argued that the Liberals understood this, and were willing to compromise:

- Corinne Comstock Weston, The Liberal Leadership and the Lords' Veto, 1907-1910, The Historical Journal, Vol. 11, No. 3 (1968)

Thus, according to Weston, Asquith and Lloyd George were willing to accept - at some risk to party unity - that Land Value Taxation would not be treated as ordinary taxation.

It did not matter, negotiations failed. The Land War was not over.

“a determined attack is being made on the system which has waged war on the well-being of the people.”

“For once the ideas and forces of revolution have got law and order on their side.”

“They have had a fair chance for the last 400 years.”

“There is no reason why men should be poor.”

“The people have got their chance now.”

“they will be free as they never have been before.”

“since private ownership of land has become the established system in the more forward countries, it has been very generally held that such a system was required in the interests of civilisation.

But of late opinion on that point has been changing.”

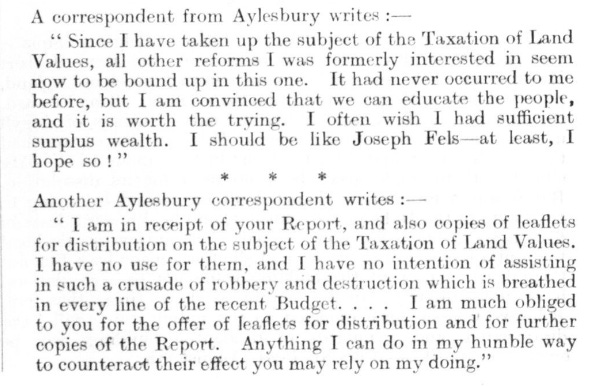

Aylesbury divided

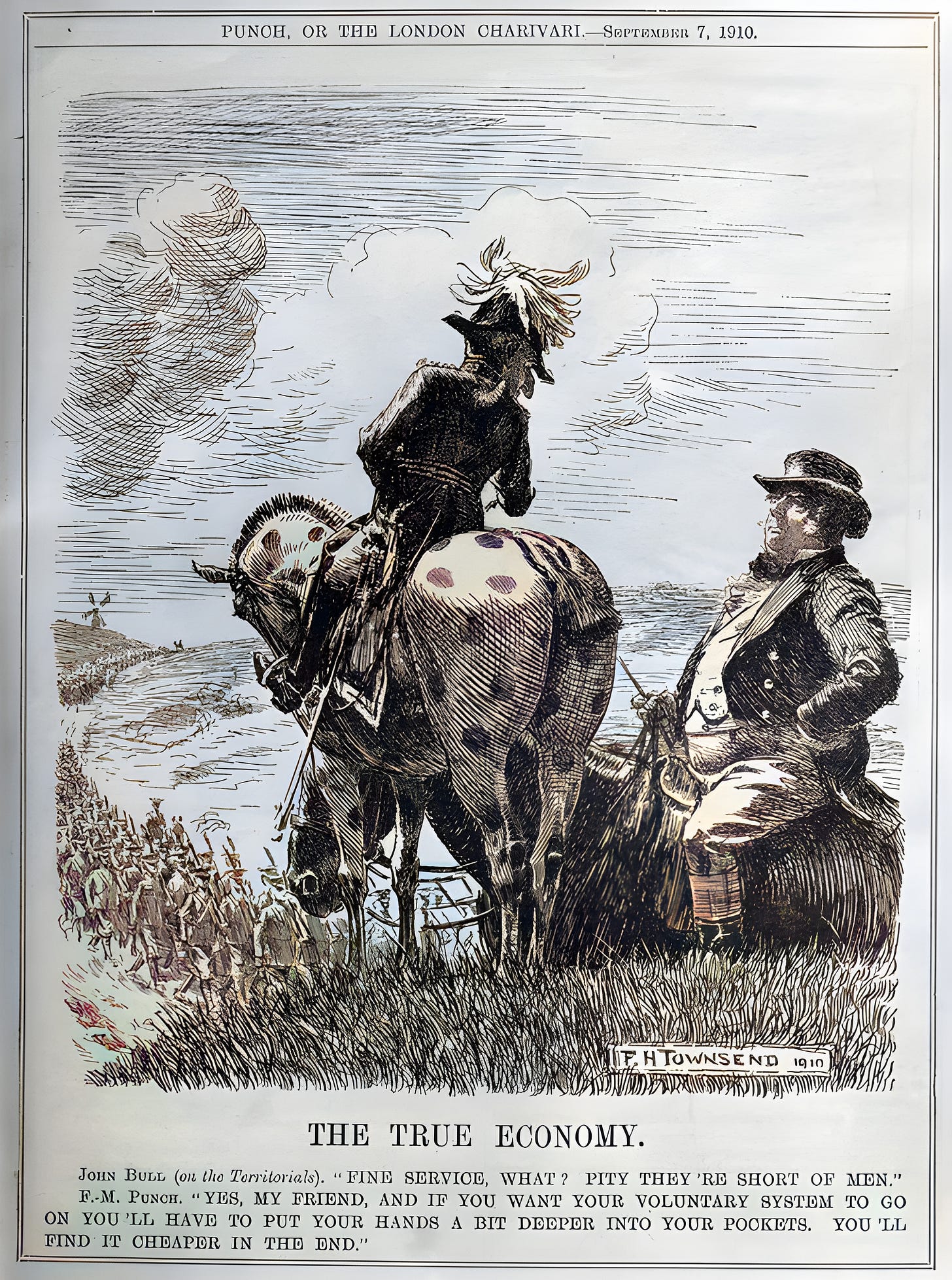

The Single Tax v The True Economy

Single Tax internationalism

Noxious: Henry George, Karl Marx, Nietzsche

The valuation: “the first necessary step towards a great national movement for land and social reform”

England: “a debating society on Land Values”

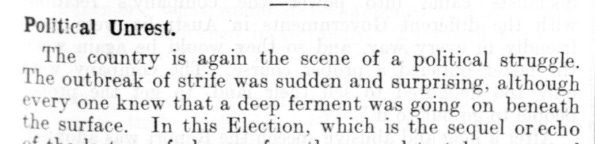

“It is in the nature of things, in the constitution of society itself, that all progress registers itself in higher land values; rent rises and wages fall.

This is the lesson that the accredited leaders of labour will not learn; but there it is - a set of stubborn facts that will not be put down by mere noise and shouting.”

“The Taxation of Land Values is the only genuine labour policy”

Three hundred million leaflets?